CounselPro for Bankruptcy TrusteesMaximize asset recovery with comprehensive financial intelligence

Complex estates demand thorough investigation. CounselPro helps you uncover hidden assets, validate debtor disclosures, and build evidence for the recovery actions that matter most in trustee administration.

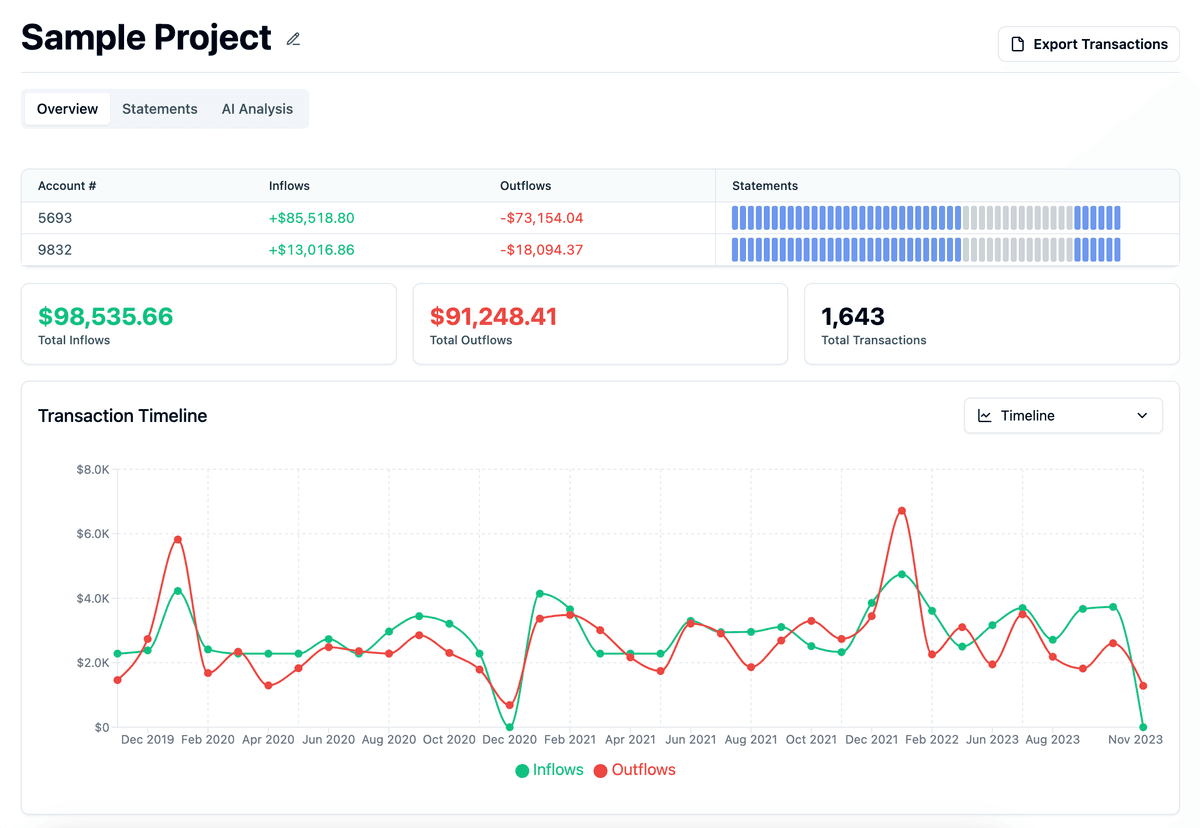

Consolidate everything into a single view

Trustee cases often involve multiple business accounts, personal checking and savings, and related entity statements — sometimes spanning years across multiple financial institutions and family members.

Traditional review methods can't handle this complexity. CounselPro combines them all into a single, searchable dataset. Preferences, fraudulent transfers, insider payments, and asset movements are automatically extracted and categorized — even if the statements are poor-quality scans or inconsistent in format.

Whether you're preparing for a 2004 exam, building an adversary proceeding, or conducting asset recovery analysis, you'll have a complete, consolidated financial history that reveals recoverable claims and maximizes estate value.

We process statements from over 10,000+ financial institutions

Designed for bankruptcy trustees

Every trustee case depends on identifying recoverable assets and proving the transactions that unlawfully diminished the estate.

Preference Recovery Analysis

Automatically flag payments made within 90 days (or 1 year for insiders) that meet preference criteria for recovery actions.

Fraudulent Transfer Detection

Identify transfers made for inadequate consideration, unusual gift patterns, and suspicious timing relative to financial distress.

Asset Tracing & Recovery

Track estate assets through multiple accounts and entities to identify recovery targets and current asset locations.

Insider Payment Investigation

Spot payments to family members, officers, and related entities that warrant closer scrutiny and potential recovery.

Uncover what debtors don't want you to find

Bankruptcy trustees face the challenge of piecing together incomplete financial pictures from debtors who may not be fully forthcoming.

Business assets mix with personal accounts. Transfers to insiders are buried in years of transaction history. Preferences hide within thousands of routine payments. CounselPro cuts through debtor obfuscation by creating a unified timeline of all financial activity.

Upload statements from business accounts, personal checking, and credit cards, and get back a single, searchable financial history that reveals exactly how money moved between accounts, entities, and related parties. You'll have the complete picture that debtors hoped would stay hidden.

Real-world trustee case example

A Chapter 7 trustee inherited a case involving a construction company with suspected insider preferences and fraudulent transfers. Three years of records from business operating accounts, personal accounts of the principals, and related entity statements created a complex web of transactions.

After uploading all statements to CounselPro, the trustee discovered:

The Result:

Analysis completed in under two hours. What would have taken weeks of manual review provided clear roadmap for recovery actions that ultimately returned over $650,000 to the estate — maximizing creditor recovery through comprehensive, technology-driven financial investigation.

Ready to see how CounselPro maximizes trustee recoveries? Get a personalized demo focused on bankruptcy trustee administration

Maximize estate recovery potential

Build compelling adversary proceedings with comprehensive financial analysis. Identify preference payments, fraudulent transfers, and hidden assets with transaction-level evidence that supports maximum recovery.

Streamline trustee administration

Reduce investigation time from weeks to hours while uncovering more recovery opportunities. Handle complex multi-entity cases with confidence and provide creditors with thorough, professional asset investigation.

Differentiate your trustee practice

Stand out in trustee appointments with sophisticated financial analysis capabilities. Demonstrate to courts and creditors that you're using cutting-edge technology to maximize estate value and recovery potential.