CounselPro for Estate PlanningBuild a complete financial picture before the planning begins

Estate planning requires precision. CounselPro turns scattered PDFs, emailed statements, and scanned paperwork into a unified, categorized view of your client's financial life — across all accounts, all institutions, and all formats.

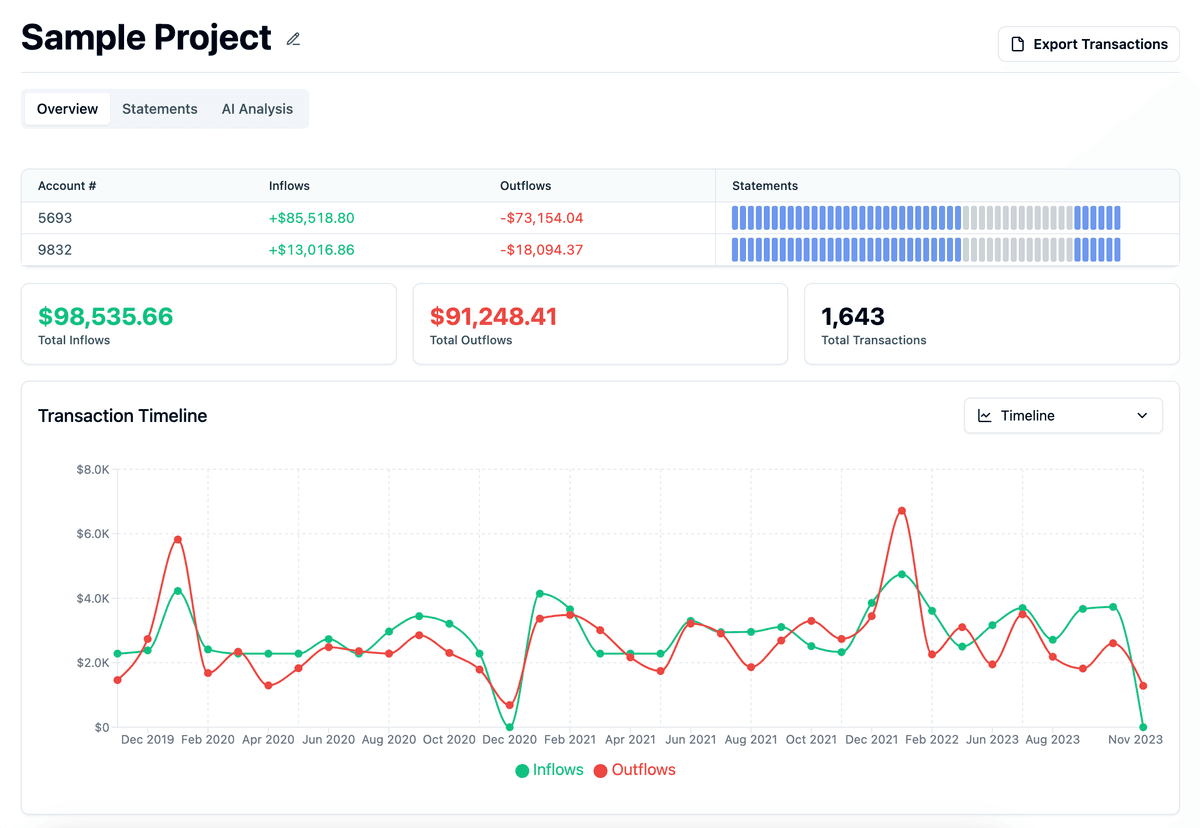

See the whole financial landscape

Estate planning requires understanding the full scope of your client's financial world — accounts, assets, income, spending, and transfers. But those records often come as scattered PDFs, emailed statements, and scanned paperwork.

CounselPro automatically extracts and categorizes every transaction from years of bank and credit card statements — even if they're scanned, misaligned, or irregular in format. Within minutes, you'll have a consolidated timeline of income and asset growth, recurring obligations, gifting patterns, and account balances over time.

That clarity enables smarter, more customized planning — and fewer surprises later. You can start every engagement from a place of insight, not guesswork.

We process statements from over 10,000+ financial institutions

From client files to strategic insight

You don't need to sort files manually, key in spreadsheets, or decode bank codes.

Upload

Years of client statements from any account type — banks, credit cards, investments, business accounts.

Extract

Every line item with AI-powered OCR that works on scanned, emailed, and irregular format statements.

Categorize

Automatically identify income, gifts, transfers, business vs. personal expenses — no tagging or setup required.

Generate

Clear, exportable reports for client meetings and estate file documentation with full transaction details.

Drive better planning conversations

With CounselPro, you can quickly answer the questions that matter most in estate planning practice.

Estate planning is about more than forms — it's about understanding. CounselPro helps you answer critical questions like: Are there regular gifts or support obligations that should be formalized? Are any accounts being commingled with business funds or adult children? Do spending patterns support specific trust structures or restrictions? Are there hidden assets or inconsistent cash flows that raise red flags?

Armed with facts, you can guide clients to better outcomes and document every decision along the way. CounselPro turns financial complexity into strategic clarity.

Real-world estate planning example

An estate attorney is brought in to update a trust for a high-net-worth client. Instead of relying on incomplete spreadsheets or self-reported data, they upload six years of bank and credit card statements into CounselPro.

The system identifies:

The Result:

The attorney uses this information to update the trust distribution language, recommend new structuring, and ensure assets are titled correctly. What would have taken weeks of client interviews and document review was completed in minutes.

Why CounselPro beats manual financial review

Stop relying on incomplete spreadsheets and self-reported data. See how CounselPro transforms estate planning financial analysis.

| Challenge | Manual Review | CounselPro |

|---|---|---|

| Analyzing years of client financial records | Hours of manual sorting and entry | Minutes of automated analysis |

| Unified view across all accounts | Spreadsheet chaos | Single consolidated timeline |

| Identifying gifting patterns and transfers | Easy to miss patterns | Automatic categorization |

| Working with scanned and inconsistent statements | Manual data entry errors | AI-powered OCR handles all formats |

| Client-facing reports | Basic Excel summaries | Professional reports with visualizations |

| Pricing for estate planning practices | High paralegal/analyst costs | $100/month for 5,000 pages |

Want a personalized estate planning demo? Schedule a demo tailored to your practice

Better planning recommendations

Start every engagement from insight, not guesswork. Understand the full scope of your client's financial world before making recommendations that will shape their legacy for generations.

Expand your estate planning services

Offer premium financial analysis services without increasing overhead. Build more comprehensive estate plans with detailed financial evidence that supports every recommendation and protects every decision.

Stand out in estate planning

Differentiate your practice by offering sophisticated financial analysis on every estate planning engagement. Show clients you're using cutting-edge technology to provide deeper insights and more precise planning.