Forensic analysis.

Drag, drop, done.Drag,drop,done.

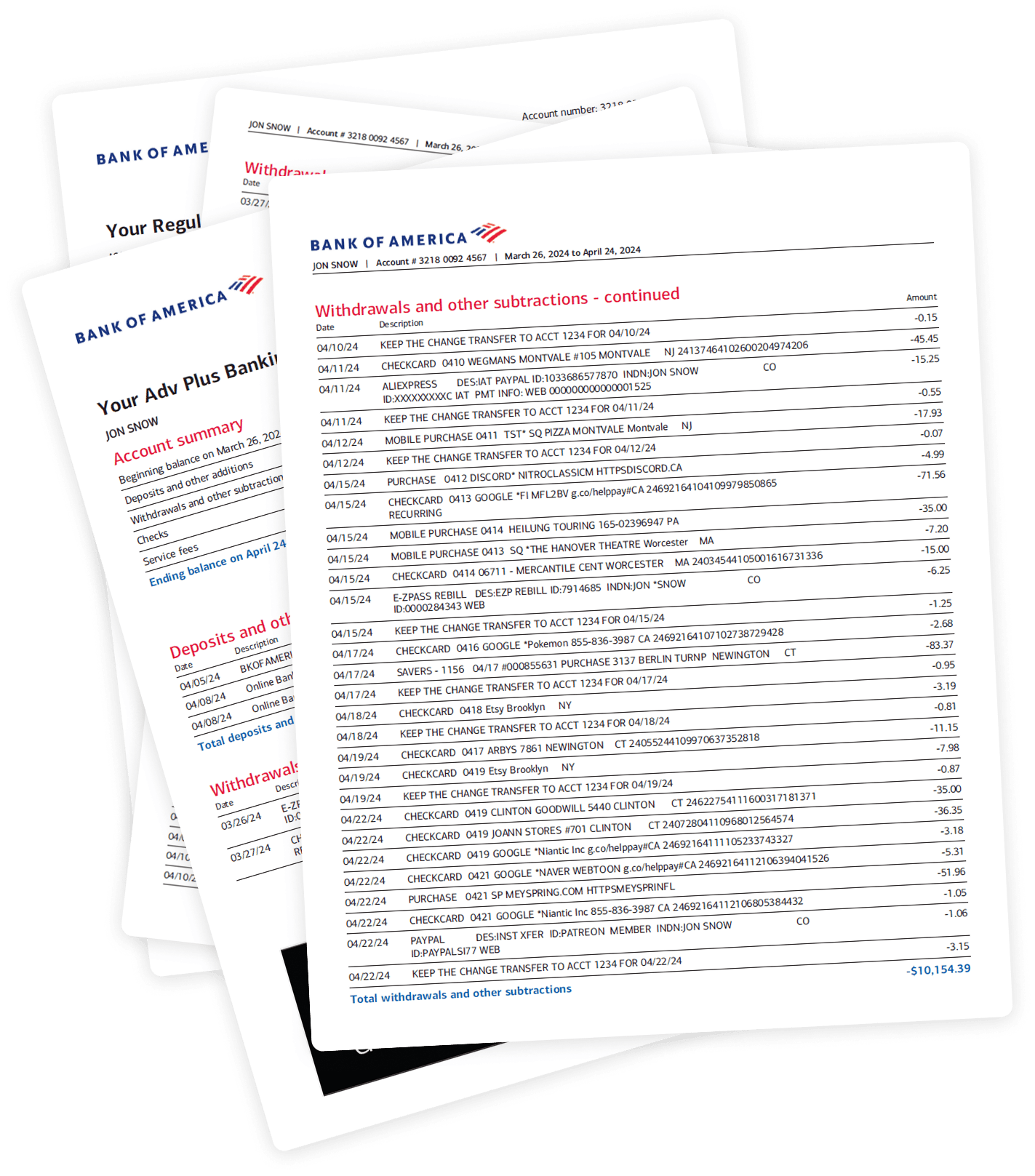

Stop spending billable hours on manual data entry. Drag financial statements into CounselPro and deliver structured workpapers and forensic insights to your clients in a fraction of the time.

We process statements from over 10,000+ financial institutions

Consolidate every account into a unified investigative dashboard

Financial investigations involve mountains of data. CounselPro combines multiple accounts across different institutions and years into a single, searchable dataset—ready to analyze and present to counsel.

Go from PDF to client deliverable in minutes.

See all accounts

See all accounts at a glance, with total inflows and outflows for each. No more jumping between banking portals or manually reconciling PDF statements.

Aggregated inflows, outflows

Aggregated inflows, outflows, and total transaction counts. Get a high-level financial profile instantly, allowing you to spot anomalies, irregular patterns, and potential red flags faster.

Interactive timeline view

Interactive timeline view of aggregated cash flows across all accounts. Filter by categories or individual accounts to drill down into spending patterns and trace funds through complex transactions.

See all accounts

See all accounts at a glance, with total inflows and outflows for each. No more jumping between banking portals or manually reconciling PDF statements.

Turn unstructured financial PDFs into a searchable financial database

CounselPro is way more than OCR. It builds the database you need to master your engagement. We extract, categorize, and structure every transaction from your PDFs, enabling you to instantly answer any financial question your client throws at you.

Automatic categorization

We don't just transcribe text; we understand it. Every transaction is automatically categorized, turning raw statements into a structured dataset ready for your forensic analysis.

Instant answers

Stop manually tallying deposits in Excel. Query your new database to instantly calculate income totals, find specific transfers, or track spending trends across years of statements.

Verifiable accuracy

Trust but verify. Our extraction engine preserves 100% fidelity to the source document, creating workpapers that stand up to deposition scrutiny and expert witness testimony.

Conduct forensic analysis in real-time

CounselPro is more than a static spreadsheet. It's a dynamic, searchable database. Stack filters and flag suspicious items to build your analysis without ever opening Excel.

Time-period analysis

Apply date range filters combined with amount thresholds to instantly isolate transactions within any lookback period. Perfect for preference analysis, fraudulent transfer investigations, or identifying pre-litigation asset movements.

Flag & export suspicious activity

Click to flag suspicious transactions—large cash withdrawals, payments to related parties, or unusual vendors. Export a 'Flagged Only' report to include in your workpapers or share with counsel.

Trace commingled funds

Select multiple accounts to view them in a single stream. Visually trace the flow of funds between business and personal accounts, or follow money through a web of related entities.

Click-to-source verification

Every finding is defensible. Click on any transaction line in the digital ledger to instantly open the original PDF source—essential for workpaper documentation and deposition preparation.

Advanced investigative search

Find the needle in the haystack. Stack search logic—e.g., description contains 'Crypto', amount >$1,000—to surface the transactions that matter for your investigation.

Daystrom™ AI Forensic Analysis

Purpose-built forensic AI that goes beyond organization to generate comprehensive narrative reports—the kind of detailed analysis that takes days, delivered in minutes.

Forensic Accounting Report

Michael Smith vs. Dr. Samantha Smith - Financial Analysis

Personally identifiable information, including transaction amounts, names, vendors, locations, and dates have been changed or redacted.

Summary Overview

This forensic accounting investigation reveals a profound and systematic misrepresentation of financial reality by Dr. Samantha Smith. Her sworn testimony and financial declarations, claiming a net monthly income of approximately $13,500, are fundamentally contradicted by analysis of records from November 2019 to June 2025. The evidence demonstrates a complex, multi-million-dollar financial enterprise characterized by substantial, undeclared cash flow and systematic commingling of funds.

Income Analysis

Detailed examination of deposits across the 14 identified accounts reveals total inflows of $4,250,000 during the analysis period, averaging roughly $68,000 per month—over 5x the declared amount. Primary discrepancies originate from three undisclosed merchant processing accounts linked to 'Naturales LLC' which bypass the primary operating account entirely.

Furthermore, the high-velocity movement of funds between corporate shells serves no discernible business purpose. On 43 separate occasions, funds were transferred from Sports RX to Naturales, then immediately wired to a personal account held at a different institution, effectively layering the income to distance it from the original source.

Additional forensic tracing identified a series of structured cash deposits at ATMs across three different counties, totaling $145,000 over 18 months. These deposits consistently fell just below the $10,000 CTR reporting threshold, a pattern indicative of intentional structuring to evade regulatory scrutiny. When combined with the 'Borne INC' wire transfers, the total unreported liquidity available to the debtor exceeds $1.2 million.

This analysis strongly suggests that the debtor's Schedule I significantly understates actual disposable income, rendering the Means Test calculation unreliable and supporting a presumption of abuse under § 707(b).

- Income AnalysisAnalyzes deposit patterns to verify consistency with stated income, identifying irregular inflows or undisclosed revenue streams requiring further investigation.

- Transaction AnalysisSurfaces timing anomalies and unusual activity sequences that may indicate fraudulent conveyance, asset concealment, or pre-litigation planning.

- Spending Pattern AnalysisReviews expenditure habits to highlight lifestyle inconsistencies, potential dissipation of assets, or payments to undisclosed parties that warrant scrutiny.

- Potential Related Party TransactionsTraces circular flows and relationships between entities to identify insider payments, self-dealing, and transactions requiring disclosure in your report.

See Daystrom in action

Get a full sample forensic report sent to your inbox to see exactly what Daystrom uncovers.

What Daystrom uncovers that humans miss

Standard review catches the obvious. Daystrom catches the sophisticated.

Entity resolution

Daystrom links every payee, identifying shell companies, undisclosed business partners, and recurring transfers to "friends and family" that disguise asset transfers.

Suspicious timing

Correlates withdrawals with key dates—like divorce filings, lawsuits, or creditor judgments. It spots the cash purge before the storm.

Hidden asset signals

Flags transactions that suggest undisclosed assets: large insurance premiums, property tax payments in other counties, or storage fees that may conceal valuables.

Structuring detection

Identifies patterns of cash withdrawals or deposits designed to evade reporting requirements, such as repeated transactions just under $10,000.

Income diversion

Detects when business revenue or personal income is routed to secondary accounts, prepaid cards, or crypto exchanges instead of the debtor's primary operating account.

Lifestyle mismatch

Compares reported income against spending habits on luxury goods, travel, and dining to highlight discrepancies that may indicate undisclosed income or fraudulent representations.

Built for both sides of the case

Whether you're pursuing recovery or defending against allegations, CounselPro's forensic engine adapts to your specific engagement needs.

Bank-grade security,

hosted in the USA.

We protect your client's sensitive financial data with AES-256 encryption and strict isolation protocols. Hosted exclusively on US-based servers.

Built on a foundation that is continuously monitored to ensure the highest standards for security, availability, and confidentiality.

We never use your client's data to train our models. Your information remains yours, isolated and private.

All data is processed and stored exclusively on US servers (East, Central, & West), complying with domestic data laws.

Stop drowning in

financial documents.

Join the forward-thinking professionals processing over $10B+ in transactions with CounselPro.