How it works

CounselPro uses advanced AI models to process financial documents, extract transaction data, and generate forensic reports

The three-step CounselPro process

1. Extract

AI reads and extracts every transaction from uploaded financial documents

2. Categorize

Intelligent AI categorization organizes transactions by type and purpose

3. Analyze

Advanced forensic AI generates comprehensive analysis and insights

This streamlined workflow transforms weeks of manual financial analysis into minutes of AI-powered insight. Here's the detailed technical breakdown of what happens at each stage.

Understanding the technology stack

CounselPro uses three distinct AI models working in sequence: a Vision Language Model (VLM) for document processing, a 40-billion parameter model (LLM) for transaction enrichment, and a 128-billion parameter (LLM) for forensic analysis. This separation ensures accuracy at each stage.

Vision Model (VLM)

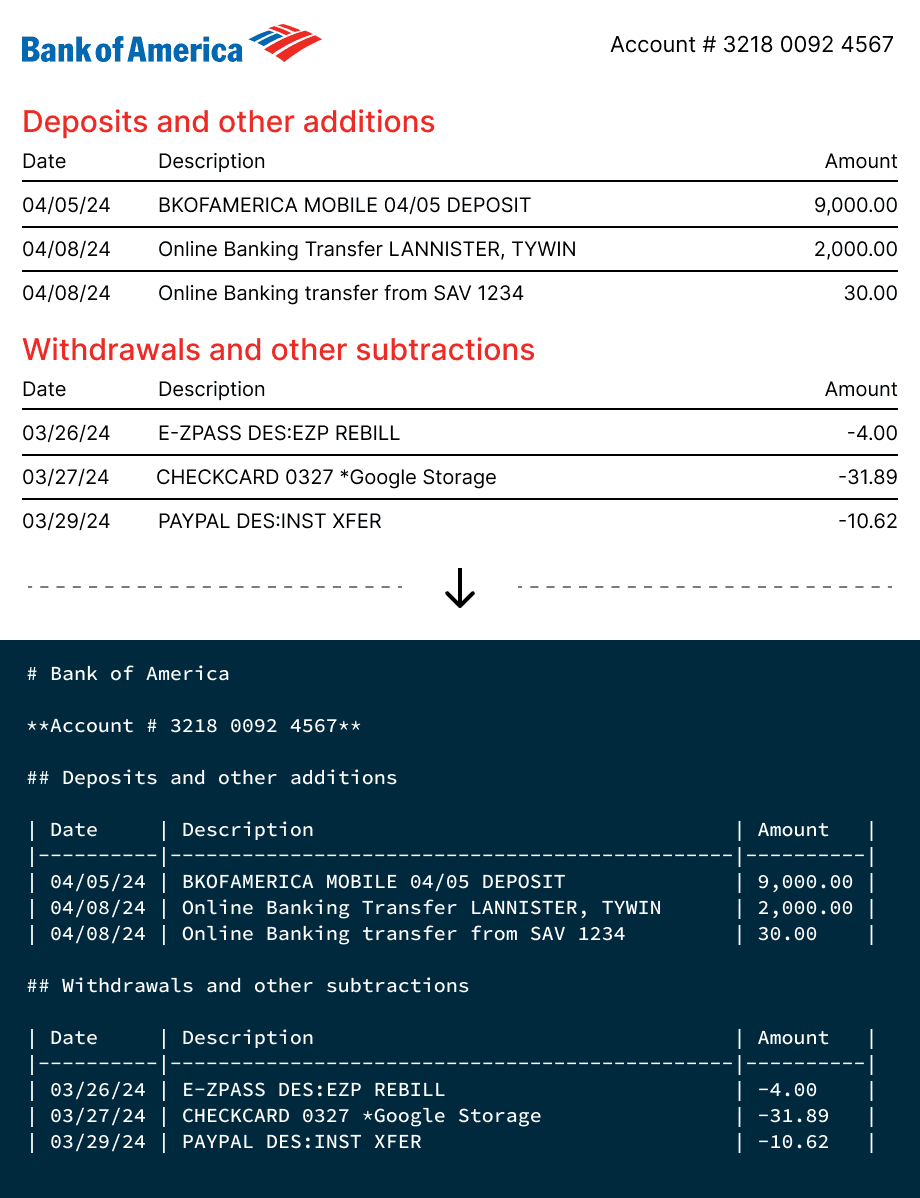

Data extraction from source documents into markdown

40B Parameter Model

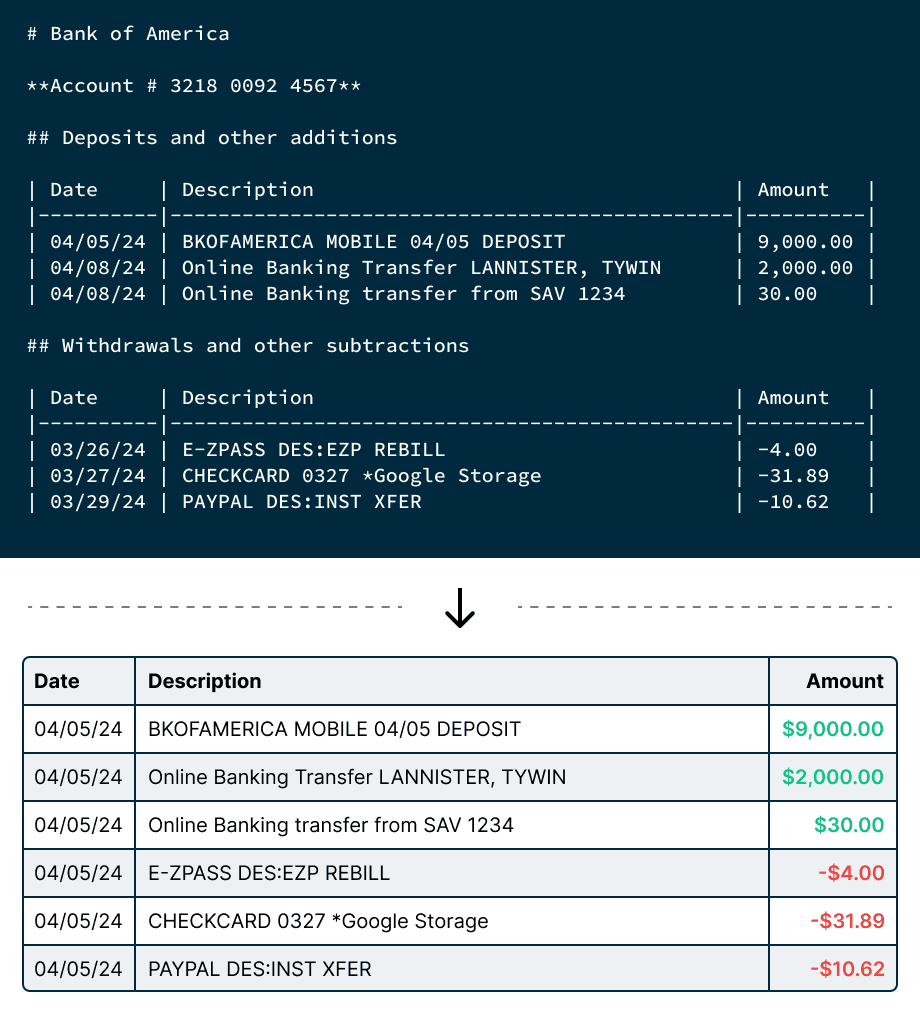

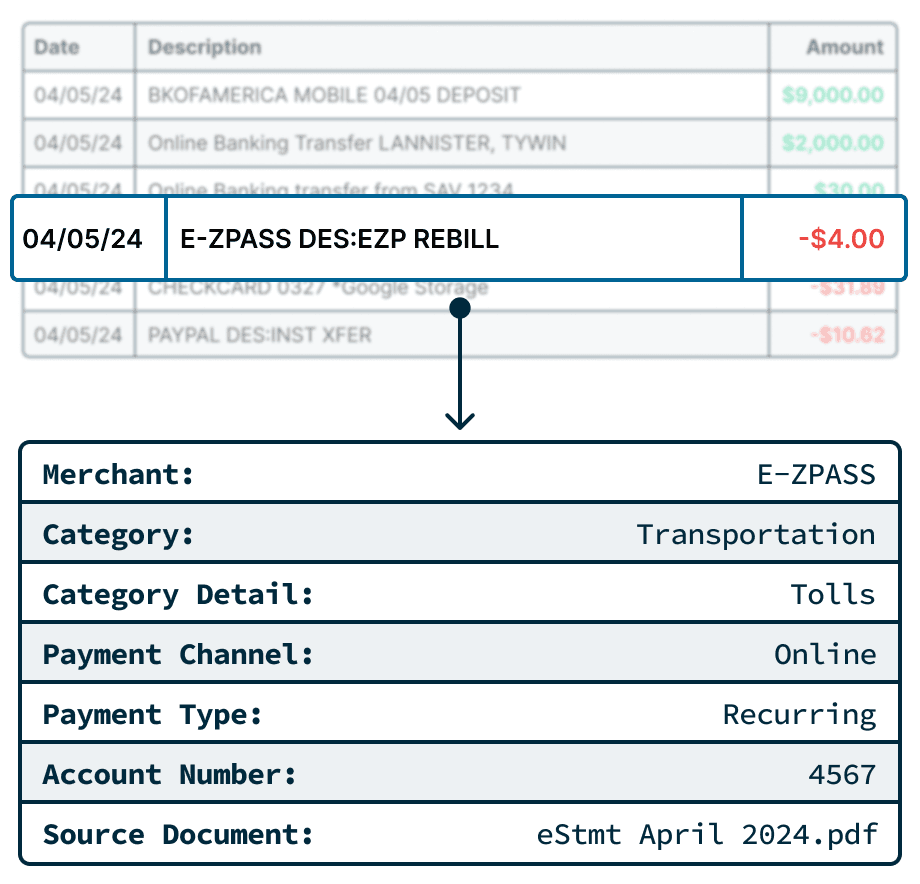

Transform markdown into structured data & categorize

128B Parameter Model

Analyze extracted & enriched data into forensic reports

Stage 1: Document ingestion and processing

You upload any PDF bank or credit card statement - certified copies, scanned documents, or digital exports from online banking.

CounselPro's VLM converts the entire document to markdown, preserving all document structure including tables, diagrams, and formatting elements. This comprehensive conversion ensures that all data, regardless of content structure, is captured by the system so that relevant details can be extracted during subsequent processing stages.

The markdown conversion creates a complete, structured digital record that maintains the integrity and authenticity of the original document. All formatting, tabular data, and document elements are preserved in a machine-readable format, ensuring that no potentially relevant information is lost during the digitization process.

Stage 2: Data structuring and validation

Our 40B parameter model analyzes the markdown from Stage 1 and extracts only transaction data into structured database entries containing date, amount, description, and account information.

By working with clean markdown structure, the model can precisely identify and extract transaction data while ignoring irrelevant content like advertisements, disclaimers, and formatting elements. This focused approach prevents hallucinations and avoids context window limitations that occur when processing entire document pages.

The model uses structured output generation with strict schema enforcement to ensure consistent data extraction. Token-level attention mechanisms identify transaction boundaries within the markdown, while the model's training on diverse financial document formats enables robust handling of edge cases like split transactions, fee deductions, and interest charges, while ignoring irrelevant content such as points and rewards.

Stage 3: Transaction enhancement and categorization

CounselPro analyzes transaction descriptions to identify merchants, categorize spending, and detect transaction types. Unlike keyword matching, it understands context and relationships.

The model functions like multiple specialized 'experts' that simultaneously analyze different aspects of each transaction description. One expert focuses on identifying business names, another on payment methods, and another on transaction types. These experts work together to build a complete picture, much like how a team of attorneys might each focus on different aspects of a contract during review.

Traditional software looks for exact word matches (like searching for 'Home Depot' to identify hardware purchases). Our AI understands context and relationships - it knows that 'ACH DEBIT MTHLY AUTO PYMT ABC LEASING SVCS 4458291' indicates a recurring vehicle lease payment processed via automated clearing house, even though terms like 'car lease' or 'monthly payment' never appear. This contextual understanding is crucial for accurately categorizing the cryptic abbreviations, payment codes, and institutional identifiers that banks use in transaction descriptions.

Stage 4: Forensic analysis by Daystrom AI

This 128-billion parameter AI model functions as a virtual forensic accountant, analyzing patterns that human reviewers might miss across thousands of transactions.

The model operates like a seasoned forensic accountant who can review years of financial records in hours rather than weeks. It identifies subtle patterns across large datasets - for example, detecting that monthly $2,847 transfers to 'J SMITH CONSULTING LLC' correlate with periods when a business owner's personal expenses increase, suggesting potential income diversion. The AI spots these connections because it can simultaneously analyze transaction timing, amounts, merchant relationships, and spending patterns across multiple accounts.

Working with clean, structured data eliminates the guesswork. Unlike human reviewers who might miss transactions buried in lengthy bank statements, or AI systems that get confused by document formatting, this model analyzes pure transaction data. It processes information in chronological batches, understanding that a single unusual transaction means little, but patterns of unusual transactions reveal the financial behaviors that matter in legal proceedings.

Why this approach works for legal practice

Speed without shortcuts

What takes forensic accountants weeks can be completed in hours while maintaining higher accuracy than manual review. The AI doesn't get tired, miss patterns, or make arithmetic errors.

Scalability

Handle multiple cases simultaneously without quality degradation. Whether analyzing 6 months or 6 years of records, processing time remains consistent.

Defensibility

Every conclusion traces back to specific source documents with clear methodology. The analysis can be replicated and verified, satisfying Daubert standards for expert testimony.

Cost effectiveness

Deliver forensic-quality financial analysis without the $300-500/hour forensic accountant fees, making thorough financial investigation economically viable for more cases.

This technology doesn't replace legal judgment - it amplifies your ability to identify financial patterns and irregularities that support your legal strategy. The AI handles the tedious data processing and pattern recognition, freeing you to focus on legal interpretation and case strategy.

Other attorneys are already using AI. Don't get left behind.

While you're spending weeks manually reviewing bank statements, forward-thinking attorneys are delivering forensic insights in hours. Don't let outdated methods cost you clients—or cases.